Release

Specialising in

mid-sized enterprises in Asia.

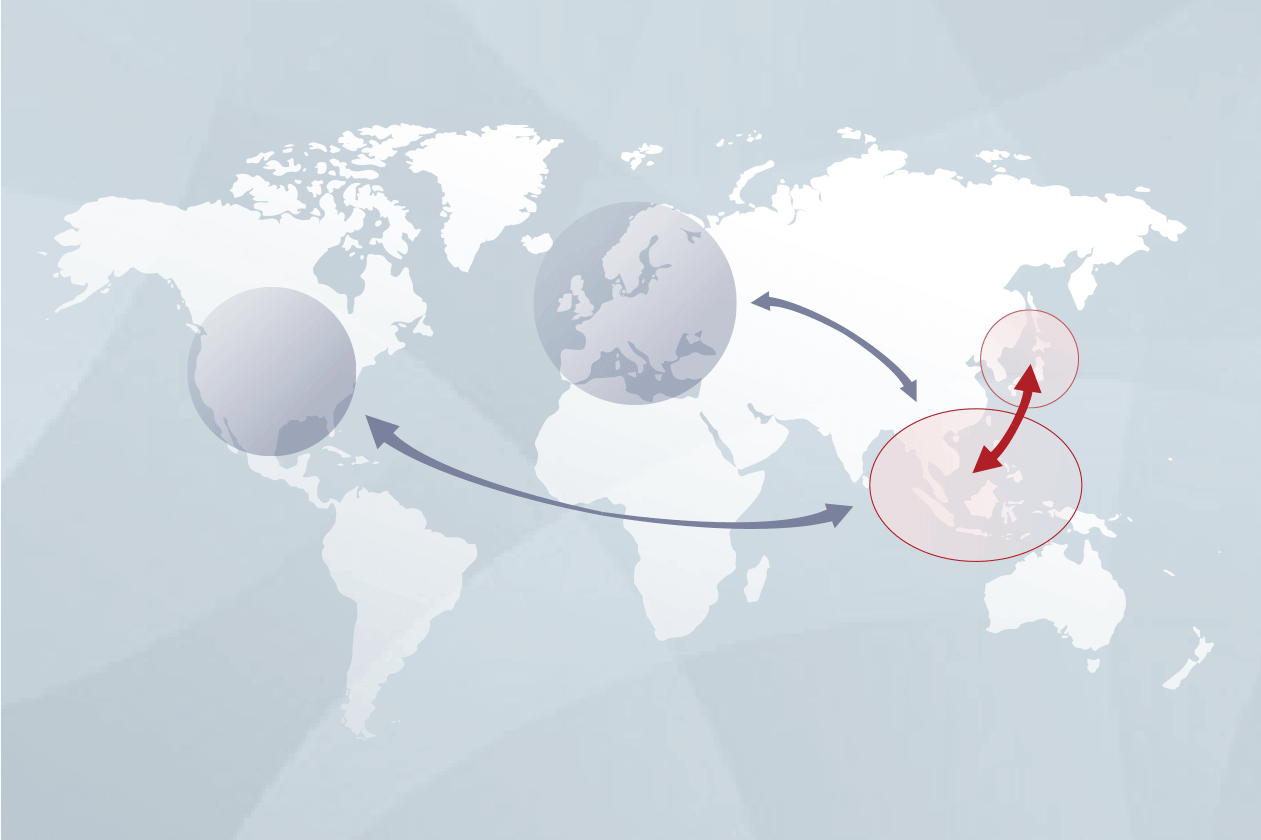

Through our local offices and network across the ASEAN five countries, which are part of the Nihon M&A Center Group, we meticulously select investment opportunities with significant growth potential.

By resolving succession issues and securing global partnerships, we invest in mid-sized Asian companies that possess the potential to thrive on a global scale. (AtoG Capital is a subsidiary of Nihon M&A Center Holdings.)